Story Content

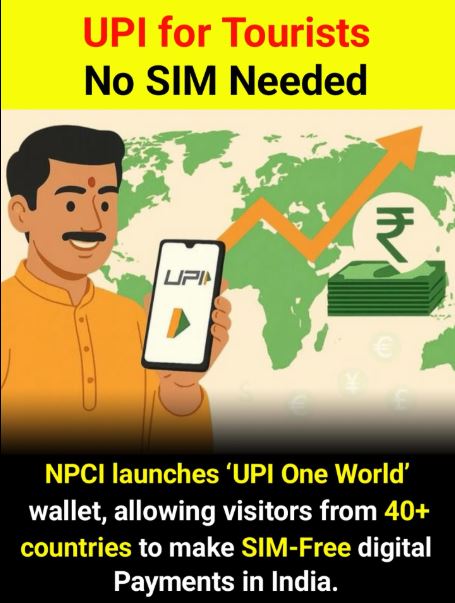

This has been a significant move to enable a seamless experience of digital payment among foreign visitors by the introduction of UPI One World, a prepaid wallet with which foreign tourist may use Unified Payments Interface (UPI) without the need to have an Indian SIM card or bank account. This pilot project, which went live in February 2026, removes one of the largest inconveniences to travellers of visiting using cash or swiping their costly international cards, and allows them to shop like locals at millions of outlets nationwide.

The service was launched at the India AI Impact Summit 2026 (February 1620, New Delhi), where it aimed to meet the representatives of more than 40 countries. Travelers are now able to open a rupee-denominated prepaid wallet, add up to 50,000 on it using their international debit or credit card, and do an immediate Person-to-Merchant (P2M) payment by scanning any UPI QR code. Indian mobile number is not needed, which is quite convenient, as the wallet is supported by authorized Prepaid Payment Instrument (PPI) issuers and special apps or counters.

Key features include:

- SIM-Free Access Use your international phone number or no phone verification during pilots set-up.

- Easy loading - Money loading through international cards at the airports (e.g. New Delhi International Airport) or the event pavilions (e.g. the stall of NPCI in the Bharat Mandapam).

- Broad Acceptance- Pay in the street, restaurants, taxis, stores, hotels- any place UPI can be used.

- Refund on Departure-Balance left can be refunded in foreign currency as per the RBI forex regulations.

- Security - Basing on the powerful encryption and fraud protection of UPI.

NPCI is also in a pilot phase (only to the summit attendees and at a small number of locations) which it hopes to roll out nationwide to all inbound tourists prior to the winter 2026-27 travel season. This is an expansion of previous global extensions of UPI to NRIs (with international figures of select countries) and manages typical pain centers of tourists such as cash addiction or card charges.

It is also in line with the vision of a cashless economy leader in India and can improve the experience of a visitor India, which could be the scanning of a QR code in Delhi with street food or a cab in Goa without having to fret over SIM swaps and forex fees. India is among the most convenient countries to make digital payments as the number of countries and users will continue to rise with progress of the pilot.

As a tourist, it is worth keeping a watch on the NPCI updates, because UPI One World might soon turn the act of carrying cash within India a thing of the past!

Comments

Add a Comment:

No comments available.